Top business insurance providers for construction firms: A Comprehensive Guide

Exploring the realm of business insurance for construction firms unveils a landscape rich with intricacies and vital considerations. This guide aims to shed light on the top insurance providers in the industry, offering valuable insights and expert recommendations to aid construction businesses in making informed decisions.

Delve into the nuances of insurance coverage tailored for the construction sector and discover the key factors that set leading providers apart in this competitive landscape.

Overview of Business Insurance for Construction Firms

Business insurance is crucial for construction firms as it provides financial protection against various risks and liabilities that may arise during project execution. Without adequate insurance coverage, construction companies may face significant losses that could impact their operations and financial stability.Construction firms typically need several types of insurance coverage to safeguard their business assets and mitigate potential risks.

Some common types of insurance policies required by construction companies include general liability insurance, workers' compensation insurance, commercial auto insurance, and builder's risk insurance.

Types of Insurance Coverage for Construction Firms

- General Liability Insurance: Protects construction firms against claims of bodily injury, property damage, and personal injury caused by their work.

- Workers' Compensation Insurance: Covers medical expenses and lost wages for employees who are injured on the job.

- Commercial Auto Insurance: Provides coverage for vehicles used for business purposes, including construction trucks and equipment.

- Builder's Risk Insurance: Protects construction projects against damage or loss due to events like fire, theft, or vandalism.

Common Risks Faced by Construction Businesses

- Construction Accidents: Falls, electrocutions, and other on-site accidents can result in injuries to workers and bystanders.

- Property Damage: Damage to client property or equipment during construction projects can lead to costly repairs or replacements.

- Contract Disputes: Disputes with clients, subcontractors, or suppliers can result in legal battles and financial losses.

- Weather-Related Risks: Adverse weather conditions like storms or floods can delay construction projects and cause damage to structures.

Factors to Consider When Choosing Insurance Providers

When selecting insurance providers for construction firms, it is crucial to consider various factors that can impact the coverage and protection of your business. Factors such as coverage options, cost, reputation, and customer service play a significant role in determining the suitability of an insurance provider for your construction company.

Coverage Options

Different construction firms may have unique needs when it comes to insurance coverage. It is essential to choose an insurance provider that offers tailored coverage options specifically designed for construction companies. This may include coverage for property damage, liability, workers' compensation, and equipment insurance.

Cost

While cost is an important factor to consider, it should not be the sole determining factor when choosing an insurance provider. It is crucial to strike a balance between cost and coverage to ensure that your construction firm is adequately protected without overspending on insurance premiums.

Reputation

The reputation of an insurance provider is another critical factor to consider. Look for insurance companies with a strong reputation in the industry, as this can provide peace of mind knowing that your insurance provider is reliable and trustworthy. Research customer reviews and ratings to gauge the reputation of potential insurance providers.

Customer Service

Good customer service is essential when it comes to insurance providers. Construction firms may need to file claims or seek assistance from their insurance company, so it is crucial to choose a provider that offers excellent customer service and support.

Look for insurance companies that are responsive, helpful, and easy to communicate with.

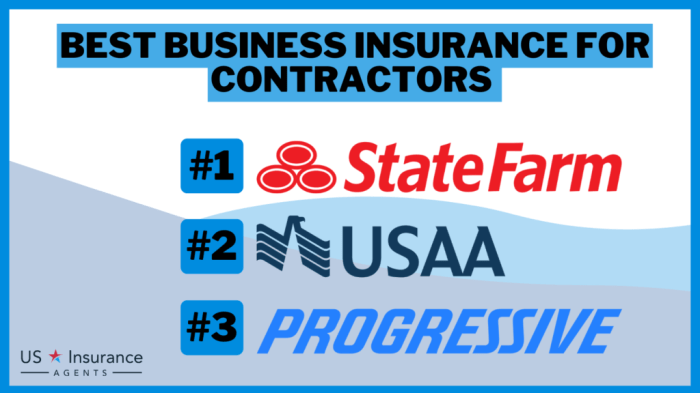

Top Business Insurance Providers for Construction Firms

When it comes to choosing the right insurance provider for your construction firm, it's important to consider factors such as coverage options, pricing, and customer service. Here are some of the top insurance providers that cater specifically to construction firms:

1. Zurich Insurance Group

Zurich Insurance Group is a leading provider of insurance solutions for construction firms. They offer a wide range of coverage options, including general liability, workers' compensation, and property insurance. Zurich is known for its competitive pricing and excellent customer service, making them a top choice for construction firms.

2. Travelers Insurance

Travelers Insurance is another top insurance provider for construction firms. They offer specialized construction insurance packages that are tailored to the unique needs of construction businesses. Travelers is known for their comprehensive coverage options and strong financial stability, making them a reliable choice for construction firms.

3. The Hartford

The Hartford is a well-known insurance provider that offers a range of insurance products for construction firms. They provide coverage for property damage, liability, and workers' compensation, along with additional services such as risk engineering and claims management. The Hartford has received industry recognition for their innovative insurance solutions and top-notch customer service.

4. Liberty Mutual

Liberty Mutual is a trusted insurance provider that offers customizable insurance solutions for construction firms. They provide coverage for a variety of risks, including property damage, bodily injury, and equipment breakdown. Liberty Mutual is known for their financial strength and reputation for delivering reliable insurance products to construction businesses.

5. Nationwide Insurance

Nationwide Insurance is a top choice for construction firms looking for comprehensive insurance coverage. They offer a range of insurance products tailored to the needs of construction businesses, including general liability, commercial auto, and surety bonds. Nationwide has received industry awards for their commitment to customer satisfaction and innovative insurance solutions.

Case Studies or Success Stories

In the construction industry, having the right insurance coverage can make a significant difference in mitigating risks and protecting businesses. Let's explore some real-life examples of construction firms benefiting from the services of top insurance providers.

Case Study 1: ABC Construction Company

ABC Construction Company was hit by a severe storm that caused extensive damage to a newly built residential complex. Thanks to their insurance provider, XYZ Insurance, they were able to file a claim promptly and receive the necessary funds to cover the repairs.

XYZ Insurance also provided additional support in assessing the damage and ensuring a smooth claims process, allowing ABC Construction Company to resume operations quickly.

Case Study 2: DEF Builders

DEF Builders faced a lawsuit from a subcontractor who was injured on-site due to a faulty piece of equipment. Their insurance provider, Acme Insurance, stepped in to handle the legal proceedings and settled the claim on behalf of DEF Builders.

Acme Insurance's expertise in liability coverage and claims management saved DEF Builders from a costly legal battle and reputation damage.

Case Study 3: GHI Contractors

GHI Contractors experienced a delay in a construction project due to unforeseen circumstances, leading to financial losses. Their insurance provider, FirstGuard Insurance, offered coverage for project delays and provided financial assistance to GHI Contractors during the downtime. This support helped GHI Contractors stay afloat during challenging times and maintain their reputation in the industry.

Summary

In conclusion, navigating the realm of business insurance for construction firms demands a keen understanding of the top players in the market. By harnessing the unique offerings and industry accolades of these insurance providers, construction companies can safeguard their operations and propel their success with confidence.

Questions and Answers

What are some common risks faced by construction businesses?

Common risks include property damage, bodily injury, subcontractor default, and project delays.

How important is business insurance for construction companies?

Business insurance is crucial for construction firms to protect against unforeseen accidents, liabilities, and financial losses.

What factors should construction firms consider when choosing insurance providers?

Construction firms should consider coverage options, cost, reputation, and customer service when selecting insurance providers.

Can you provide examples of tailored offerings by top insurance providers for construction companies?

Some tailored offerings include contractor's equipment coverage, builder's risk insurance, and surety bonds.