How to Start a Construction Investment Business: A Comprehensive Guide

Embarking on the journey of starting a construction investment business opens up a world of opportunities and challenges. This guide delves into the crucial aspects of this venture, providing valuable insights for aspiring entrepreneurs looking to enter the construction industry.

From market research to financial management, legal considerations to building a network, every step is essential in laying a strong foundation for a successful construction investment business.

Research and Planning

Before starting a construction investment business, it is crucial to conduct thorough market research and create a well-thought-out business plan. This initial phase sets the foundation for a successful venture by providing valuable insights and strategies.

Importance of Market Research

Market research is essential for understanding the construction industry landscape, identifying target markets, and evaluating competition. It helps in making informed decisions, assessing demand for construction projects, and determining potential risks and opportunities.

- Analyzing market trends and dynamics

- Identifying target demographics and customer preferences

- Evaluating the competitive landscape

- Assessing regulatory requirements and compliance

Key Factors for Market Research

Creating a comprehensive business plan involves considering various key factors specific to the construction industry. These factors play a critical role in shaping the direction and strategy of the investment business.

Factors to Consider:

- Local market conditions and demand for construction services

- Economic indicators and industry trends

- Available resources and skill sets within the construction sector

- Technological advancements impacting construction practices

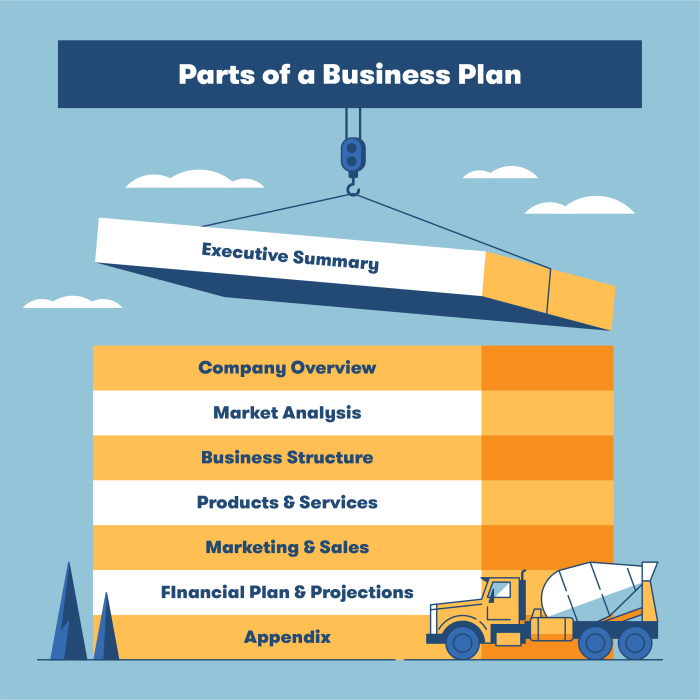

Creating a Business Plan

Developing a thorough business plan is essential for outlining the goals, strategies, and financial projections of a construction investment venture. It serves as a roadmap for the business, guiding decision-making and securing potential investors or financing.

- Executive summary outlining the business concept and objectives

- Market analysis detailing industry trends and competitive landscape

- Operational plan defining the structure and processes of the business

- Financial projections including revenue forecasts and budgeting

Legal Considerations

Starting a construction investment business comes with a set of legal requirements and regulations that need to be carefully considered. Ensuring compliance with these laws is crucial for the success and sustainability of your business.

Permits and Licenses

In the construction sector, obtaining the right permits and licenses is essential to operate legally. These permits may vary depending on the location and scope of your projects. Common permits include building permits, zoning permits, and environmental permits. It is important to research and understand the specific requirements in your area to avoid any legal issues.

Business Structure

Choosing the right business structure is crucial for a construction investment business. The most common structures include sole proprietorship, partnership, corporation, and Limited Liability Company (LLC). Each structure has its own legal implications, such as liability protection, tax considerations, and management flexibility.

Consulting with a legal professional can help you determine the best structure for your business goals.

Financial Management

Securing funding for a construction investment business is crucial for growth and success. One strategy is to approach banks or financial institutions for loans or lines of credit. Another option is to seek out private investors or venture capitalists who are interested in investing in construction projects.

Additionally, crowdfunding platforms can be utilized to raise capital from a larger pool of individual investors.When budgeting for construction projects, key financial considerations include estimating project costs accurately, accounting for contingencies and unexpected expenses, and managing cash flow effectively. It is essential to track expenses closely, monitor progress against budget, and adjust as needed to ensure the project stays on track financially.

Potential Sources of Revenue and Investment Returns

- Revenue from construction projects: Income generated from completing and selling properties, or from renting out properties for passive income.

- Investment returns from property appreciation: Real estate values tend to increase over time, providing investors with capital gains.

- Interest income from financing: Charging interest on loans provided to developers or buyers can also be a source of revenue.

- Profit sharing agreements: Partnering with developers or other investors on projects can lead to sharing profits from successful ventures.

Risk Management and Insurance

When it comes to running a construction investment business, it's crucial to understand and effectively manage the risks involved. From unexpected delays to cost overruns, there are various challenges that can impact the success of your projects. Implementing a robust risk management strategy and securing the right insurance coverage are essential steps in safeguarding your investments and minimizing potential losses.

Types of Risks in Construction Investments

- Market Risks: Fluctuations in the real estate market can affect the demand for new construction projects and impact your profitability.

- Project Risks: Delays, design errors, or unforeseen issues during construction can lead to increased costs and delays in project completion.

- Legal Risks: Compliance with building codes, zoning regulations, and other legal requirements is crucial to avoid fines, penalties, or project shutdowns.

- Environmental Risks: Issues related to environmental regulations, hazardous materials, or natural disasters can pose significant risks to construction projects.

Mitigating Risks and Contingency Planning

Effective risk management involves identifying potential risks, analyzing their impact, and developing strategies to mitigate them. This can include conducting thorough due diligence before investing in a project, creating contingency plans for unexpected events, and establishing clear communication channels with stakeholders.

By proactively addressing risks and having a contingency plan in place, you can minimize the impact of unforeseen challenges and protect your investments.

Types of Insurance Coverage for Construction Businesses

- General Liability Insurance: Protects against claims of bodily injury, property damage, or personal injury arising from construction activities.

- Builder's Risk Insurance: Covers damage to a construction project during the building process, including theft, vandalism, or natural disasters.

- Workers' Compensation Insurance: Provides coverage for employees who are injured on the job, covering medical expenses and lost wages.

- Professional Liability Insurance: Protects against claims of negligence, errors, or omissions in design or construction services.

Importance of Risk Assessment in Construction Sector

In the construction sector, conducting comprehensive risk assessments is crucial to identify potential threats to a project's success and develop strategies to mitigate them. By evaluating risks related to project scope, budget, timeline, and external factors, construction businesses can make informed decisions, minimize uncertainties, and increase the likelihood of project success.

Building a Network

Building a strong network is crucial for the success of a construction investment business. By establishing relationships with contractors, suppliers, and other industry professionals, you can access valuable resources, expertise, and opportunities that can help your business thrive.

Tips for Building Relationships

- Attend industry events and conferences to meet potential partners and collaborators.

- Join local construction associations and networking groups to connect with industry professionals.

- Utilize social media platforms like LinkedIn to expand your network and stay updated on industry trends.

- Offer to collaborate on projects or share resources with other businesses to build mutual trust and support.

- Regularly follow up with contacts and maintain open communication to nurture relationships over time.

Significance of Networking

Networking plays a vital role in the construction industry as it opens doors to new opportunities, projects, and partnerships. By building a strong network, you can gain valuable insights, referrals, and support from industry peers, which can lead to business growth and success.

Key Networking Events and Platforms

- Industry trade shows and exhibitions where you can meet potential partners and suppliers.

- Local chamber of commerce events that bring together businesses from various sectors.

- Online platforms like Procore, ConstructConnect, and BidClerk for connecting with contractors and subcontractors.

- Networking events hosted by construction associations such as ABC (Associated Builders and Contractors) or AGC (Associated General Contractors).

- Collaborative projects with other businesses in the industry to expand your network and showcase your capabilities.

Final Conclusion

As we conclude our exploration of how to start a construction investment business, it becomes evident that meticulous planning, strategic decision-making, and effective networking are key ingredients for thriving in this dynamic sector. By following the guidelines Artikeld in this guide, aspiring business owners can navigate the complexities of the construction industry with confidence and foresight.

FAQs

What are the common mistakes to avoid when starting a construction investment business?

Ensuring thorough market research, proper financial planning, and compliance with legal regulations can help avoid pitfalls in the initial stages of setting up a construction investment business.

How can one attract potential investors for a construction investment venture?

Building a solid business plan, showcasing past successful projects, and highlighting potential returns on investment are key strategies to attract investors to a construction investment business.

What role does technology play in modern construction investment businesses?

Technology aids in project management, cost estimation, and resource optimization, enhancing efficiency and productivity in construction investment ventures.